Confused About Automated Trading? Here’s What I Learned Starting from Zero

Let me guess: you’ve heard about automated trading and thought, “Could a robot actually make me money?”

Then came the wave of doubts.

- Is it too complicated?

- Do I need some high-tech setup?

- What if I’m just not cut out for this?

That was me a few months ago.

I’d never traded a day in my life.

Honestly, I didn’t even know what a “pip” was.

I’m just a regular guy who wanted to see if this whole automated trading thing was as good as people made it sound.

So, if you’re feeling overwhelmed, I get it.

Let me walk you through how I got started.

From total rookie to someone who’s now earning while binge-watching Netflix.

Starting from Nothing

First off, I had zero experience.

Like, I barely understood how the stock market worked.

But I kept hearing about automated trading bots and how they could do the heavy lifting for you: analyze markets, place trades, even close them...all while you’re off doing your thing.

Sounded like magic.

Of course, I was skeptical.

A robot making me money? Yeah, right.

But then I thought, “What’s the worst that can happen?”

So I decided to give it a shot.

Top 5 Dumbest Mistakes

- Mistake #1: Dumping Your Entire Life Savings Into It - When I first tried automated trading back in January 2023, I was so excited I almost put all my $1,000 savings into it. Thankfully, I didn't because who knows what would've happened if the EUR/USD pair had taken a nosedive like it did that summer. Start small, maybe with $100 or even less, just to see how the bot handles the GBP/USD on a single day.

- Mistake #2: Rushing Without Reading the Manual - Take your time to learn the basics. It's not rocket science; it's more like following a recipe for your favorite pasta dish.

- Mistake #3: Ignoring the Demo Account - Here's a piece of dad advice: don't jump into the deep end without swim lessons. I used the demo for over a month before going live, trading imaginary gold (XAU/USD) and silver (XAG/USD) just to get the hang of it.

- Mistake #4: Not Having a Plan B - Remember when the USD/JPY went wild on November 17, 2024? I had no exit strategy set up and let's just say, I learned to always have one. Having a plan is like bringing an umbrella to a picnic - you hope you won't need it, but you'll be glad you did.

- Mistake #5: Overcomplicating Your Setup - When I started, I thought I needed the latest supercomputer to run the trading bot. Turns out, my old laptop from 2019 runs the bot just fine, as long as you have MetaTrader 4 or 5 installed.

What You Actually Need

Turns out, getting started was way simpler than I expected.

Here’s what I needed:

- A computer or laptop – Nothing fancy. My old laptop did the trick.

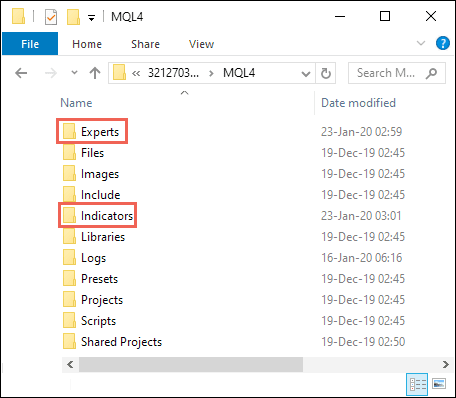

- MetaTrader 4 or 5 – This is the platform where the trading happens. You download it from your broker’s website (I just Googled “brokers that work with MetaTrader”).

- Galileo FX – The trading bot that made all this possible. It’s basically the brain of the operation, following the settings you choose (don't worry, it's super easy and fun!).

That’s it.

No extra gadgets or coding skills required.

If you can browse the internet, you can handle this.

The Setup

Here’s the part I was worried about: installing and setting it up.

I was sure I’d mess something up.

But Galileo FX had this super simple guide and a video that walked me through everything.

In about 15 minutes, I had the bot installed and running on a demo account.

The demo account was key.

It let me see how everything worked without risking real money.

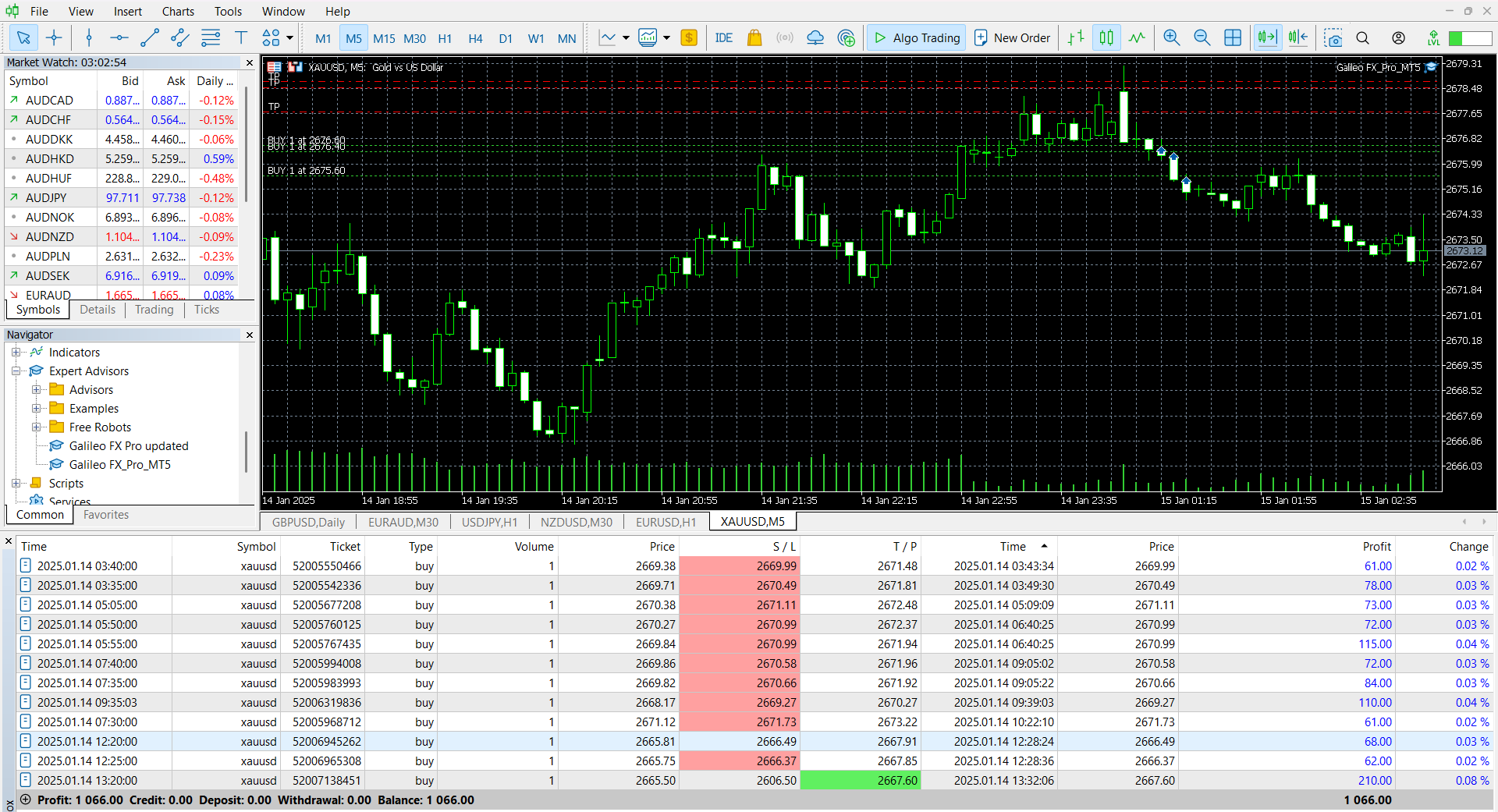

I played around with the settings, tested a few settings and watched as the bot made trades automatically.

No stress, no pressure.

Why I Stopped Overthinking It

Here’s the truth:

I spent way too much time second-guessing myself at first.

“What if I lose money?”

“What if I set it up wrong?”

But then I realized something.

This bot isn’t about gambling. It’s about sticking to a plan.

Galileo FX doesn’t make random trades.

It waits for specific patterns and follows the settings you pick.

For example, I used their Performance Page to download a strategy that matched my style (a conservative one...I wasn’t ready to go full throttle).

With just a couple of clicks, I loaded it into the bot. Boom. Done.

The First Trade

I’ll never forget my first real trade.

The bot spotted an opportunity, opened a position and closed it with a small profit all while I was making coffee.

I literally made money while waiting for my espresso machine to finish.

That’s when it hit me: “This is actually working.”

I’m not saying every trade has been a winner.

No one can promise that, and if they do, run the other way.

But the bot doesn’t get emotional.

It doesn’t panic or chase bad trades like I might if I were doing this manually.

It just follows the rules I set.

What About Risk?

Let’s talk about the big elephant in the room: risk.

I was scared of losing money (who isn’t?), but Galileo FX has features to protect you.

Stop-loss settings, trade limits, and even a demo account to practice on.

I never had to worry about my funds because the bot doesn’t touch them.

Everything stays in your broker account, safe and sound.

I kept things small at first... just testing the waters with a little bit of money.

Once I saw how it worked, I got more comfortable.

What I Wish I Knew Sooner

- You don’t need to know everything – I spent way too much time over-researching. The bot handles the hard stuff.

- Start small – Use the demo account. Get a feel for it before diving in.

- You’re in control – The bot follows your settings, not the other way around. You can be as cautious or aggressive as you want.

Why It’s Worth It

These days, I let Galileo FX do its thing while I go about my day.

I don’t stress about trades or spend hours staring at charts.

Sure, I check in now and then, but mostly, I trust the process.

I’m not some trading guru or tech genius.

I’m just a regular guy who wanted to see if this could work... and it does.

If you’re on the fence, my advice?

Start small, take it slow and see for yourself.

Automated trading sounds intimidating, but trust me: if I can do it, you can too.