Manual vs Bot Trading: What the Data Tells Us

Tired after work but still want to grow your money? You’re not alone.

Every day, more people — warehouse workers, office staff, delivery drivers, nurses — are trying to do something smart with their money.

But here’s the problem:

Manual trading is complicated.

Charts, signals, strategies — it feels like a full-time job.

So here’s the big question:

Can an AI bot actually do it better — without you needing to lift a finger?

We tested it. The results were surprising — and honestly, kind of exciting.

⚔️ Human vs Bot: We Put Them to the Test

We set up two accounts.

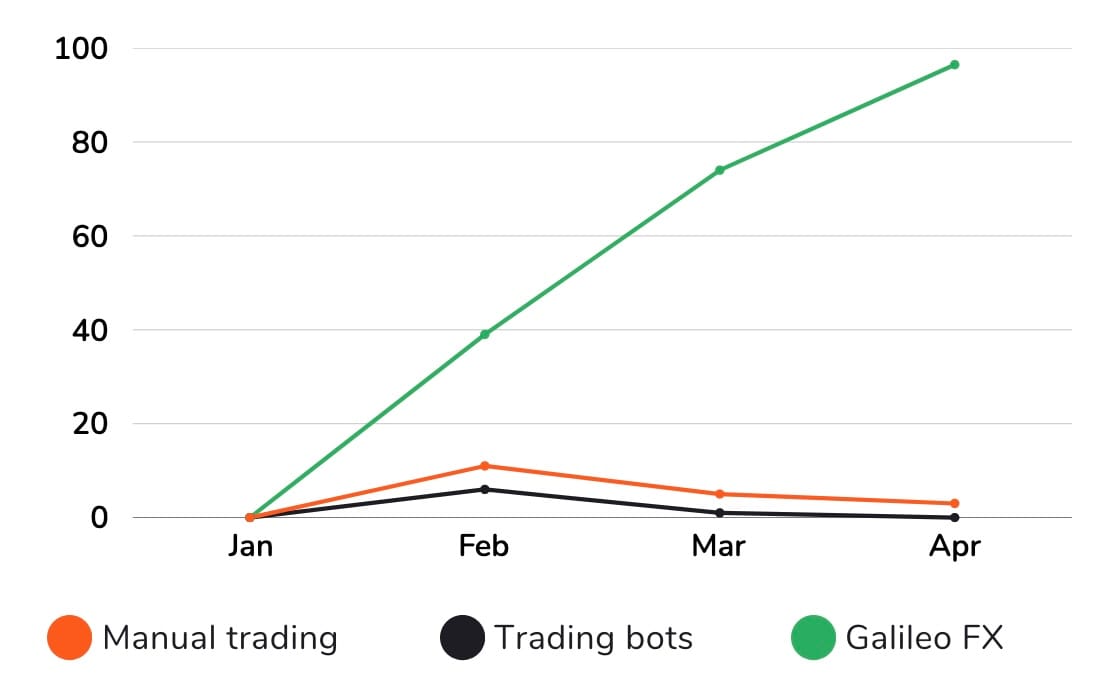

Same amount of money. Same market conditions. 90 days. One was traded manually by a real person. The other? Handed off to an AI trading bot called Galileo FX.

Here’s what happened:

- Manual Trading:

+$720 profit — but took nearly 90 hours of watching charts, placing trades, and stressing. - AI Bot Trading:

+$2,180 profit — with less than 5 hours of total effort.

(It literally ran in the background while the user worked their day job.)

Let that sink in.

The bot made more money. In less time. With less stress.

🤔 But Wait — Can Anyone Use This?

Yes. You don’t need experience. You don’t need to learn strategies. You don’t need to watch the market all day.

This is built for people like:

- The busy parent who’s always working and still barely making it

- The overworked 9-to-5er who wants their money to grow while they rest

- The first-timer who just wants something simple and honest

All you need is:

✅ A phone or laptop

✅ Wi-Fi

✅ A few minutes to set it up (once)

After that, it runs on its own.

🤖 Why Bots Are Winning Right Now

Trading bots like Galileo FX work differently than people.

They don’t get tired.

They don’t panic when the market moves.

They don’t “forget” to follow a strategy.

They just… follow the plan. Over and over. Automatically.

It’s like having a second paycheck — without a second job.

🙋 What If You’ve Never Traded Before?

Perfect. That’s who this is designed for.

We’re not talking about buying crypto or day-trading like a Wall Street pro. We’re talking about an AI tool that does the hard work for you — while you work, sleep, or do life.

Even total beginners are using it to:

- Make extra income quietly in the background

- Grow small savings over time

- Finally feel like they’re getting ahead

🛠️ Real People. Real Results.

“I’m a single mom with two jobs. I don’t have time to learn trading. But this bot? I set it up and forgot it. Checked back a month later — it made more than my side hustle.”

— Sarah T., Atlanta

“I work in a warehouse all day. I was skeptical, but I started with $100 just to test it. Two months later, I was up $180 — and I didn’t do a thing.”

— Luis M., Texas

🧭 What’s Next?

This doesn’t require thousands to get started.

You can try it small. Watch how it works. Scale up if it clicks.

If you’ve been waiting for something that feels:

✅ Simple

✅ Low-effort

✅ Genuinely helpful

This might be it.

🔓 Ready to See the Bot in Action?

Tap below to see how Galileo FX works — and how everyday people are using it to grow their money while they work.

🟩 Show Me How the AI Bot Works

Disclaimer: The information provided in this article is for educational and informational purposes only and should not be construed as financial or investment advice. Trading in financial markets involves risk, and past performance does not guarantee future results. While the data and results referenced are based on controlled demo environments and available market conditions at the time of testing, actual outcomes may vary. Readers should conduct their own research or consult with a licensed financial advisor before making any trading decisions. The mention of platforms such as Galileo FX does not constitute an endorsement or recommendation.